The end of November is usually a quiet time in politics. Most elections have ended, legislators are already planning their holiday breaks, and markets experience only moderate levels of political spending. But this November, Michael Bloomberg purchased $38M of airtime to announce his candidacy for president. The amount of money he dropped in one week dwarfed the $10M total spent by all other political advertisers during that same time period. The buy included nearly 100 media markets and additional spending on cable and national broadcast. On average, when Bloomberg entered a market, he increased the political spending by 28 times what it was in the week preceding his buy.

Market Level Rate Data

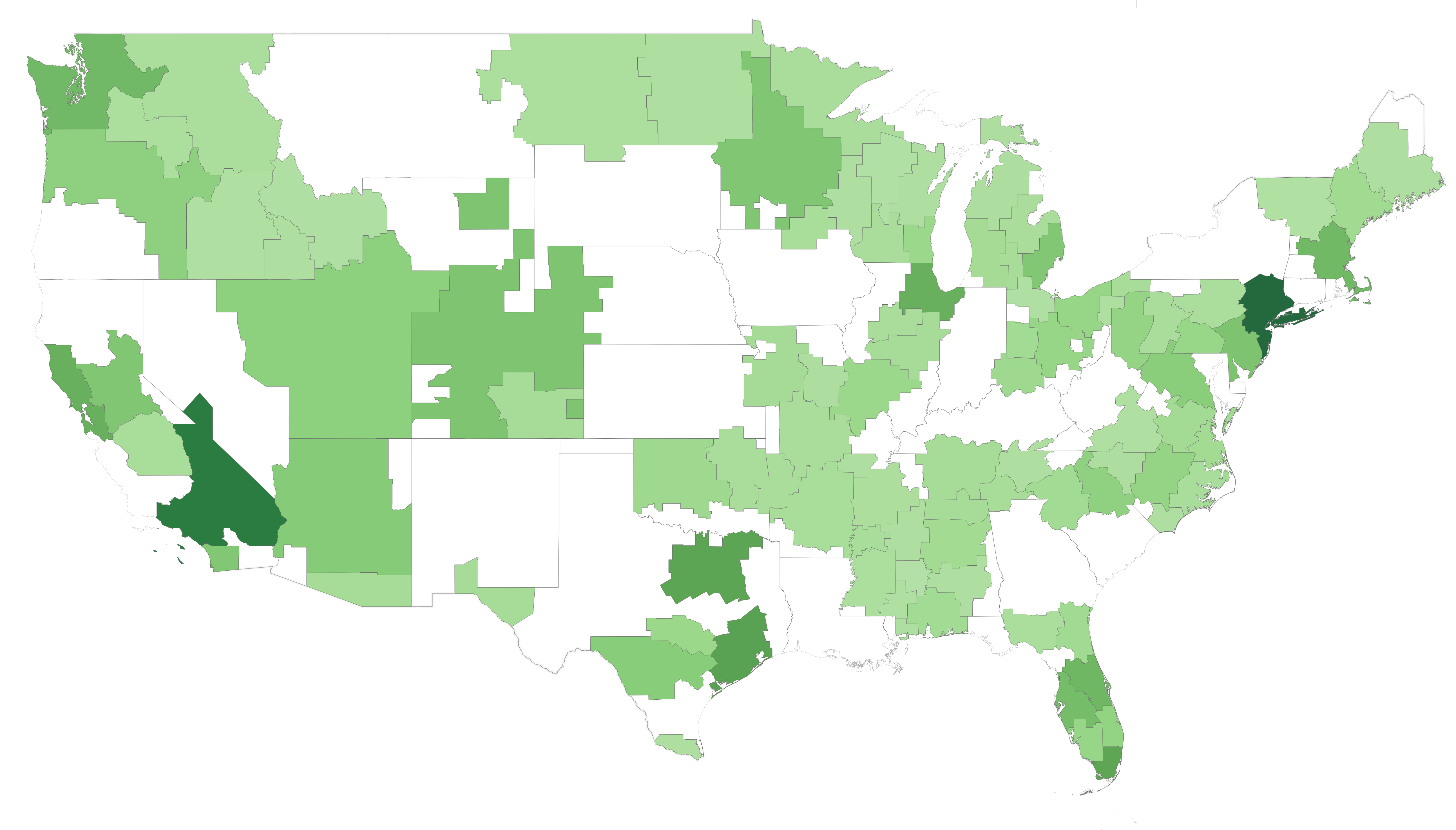

Markets purchased in Bloomberg’s first buy

Nov. 25 - Dec. 2

Bloomberg’s buy allows us to examine how stations and markets respond to new advertisers and specifically assess the question of whether prices will increase. Monitoring station/market responses allows us to review what is essentially a natural experiment of the impact of new advertisers entering markets.

Reviewing our Pharos database of FCC Public File rates for the week of Bloomberg’s first flight and the week previous, we found that overall, stations and markets raised rates (measured as cost per points) as Bloomberg entered their market. The typical market increased their rates by 22 percent as the political spending poured in.

Houston was among the markets that responded most actively to the new advertiser. This is partially attributable to Bloomberg’s $1M buy increasing the political spending in the market tenfold. This shock spending increase was matched by a 45% increase in rates, which is among the highest of any market. Other markets were affected less, like Bangor, Maine. Bloomberg’s buy here was a much smaller $61k. In addition, spending by other political advertisers decreased causing total political spending to only increase by 8 percent week-over-week.

Evidently, the larger sized buys affected market responses more dramatically. Looking at the quantities of spots purchased per market by Bloomberg, prices increased about 1.5 percent for every percent increase in purchased spots. We conclude that on average, rates were measurably raised in markets where Bloomberg spent money and larger rate hikes appeared where more inventory was purchased. With no end in sight for his ad blitz, we will continue to collect data on the way Bloomberg’s spending affects rates in markets across the country.

For more information please contact John Link jlink@advertisinganalyticsllc.com