Written by Ethan Mort and Josh Fried

According to a press release from the US Census, there were 254,582 fast food restaurants in the United States in 2019. With a market size of $362B in 2022, the fast food industry is an incredibly expansive market that continues to grow and shift with each passing year. As the industry changes, so does its advertising. In 2022, AdImpact tracked 245.7M broadcast and cable airings. 11.6M of them were from fast food advertising. In Q1 2023, 58.3M airings were tracked, 2.2M of those being fast food airings.

2022 Q1 vs 2023 Q1 Analysis

AdImpact broke down the total number of fast food advertising by specific advertiser, and it revealed some interesting patterns. In Q1 of 2022, the top ten fast food advertisers made up 1.8M airings, or 15% of the total number of fast food airings across 2022. Within the first quarter, McDonalds and Domino’s were neck in neck for number of airings in the nation, with Wendy’s and Sonic in a distant third and fourth place. KFC, Subway, and Dunkin’ made the top ten list in the first quarter of 2022 but have not yet made the list for 2023. Panera, Pizza Hut and Popeyes made the list for the first quarter of 2023, after missing it in Q1 2022.

Looking at a more complete picture of 2022, the fast food advertising patterns from the first quarter continued through the remainder of the year. McDonalds slightly expanded their lead over Domino’s, but there is still a large airings gap between McDonalds and Domino’s vs every other fast-food advertiser. Arby’s moved up a spot to go from the seventh top fast-food advertiser regarding airings in the first quarter, to the sixth highest advertiser. By the end of 2022, Dunkin was replaced in the top ten by Pizza Hut.

2022 Fast Food Competitors Analysis

The fast-food market space is one known for its stark competition. If you ask coworkers if they would like a coffee, they’ll likely ask “Dunkin or Starbucks?”. If you’re hungry on your commute back home and craving a burger, it might be a tough choice between McDonalds, Wendy’s or Burger King. If you’re deciding what pizza to pick up for your family, the choice will probably be between Domino’s, Pizza Hut and Papa John’s. Within each of these market spaces, each competing fast food advertiser will pursue a different advertising strategy by focusing their efforts on different markets, flooding some media markets with airings, and ignoring others.

Dunkin Donuts, founded in Quincy, Massachusetts, and Starbucks, founded in Seattle represent a battle between the East and West in the pursuit of national dominance of the fast coffee market. In terms of total airings in 2022, the two coffee companies are practically tied—where Dunkin has 401K airings, and Starbucks has 478K airings. The two companies focused their airings on markets opposite to where they are primarily originally based in. Dunkin’s top market is in Los Angeles, and Starbucks’ is in New York. Dunkin’s concentrates their airings in urban markets, while Starbucks has more airings spread out across the country. Dunkin’s advertising strategy strays from coffee and instead focuses on their products beyond coffee. For example, Dunkin’s most aired ad in 2022 at 32K airings featured their coffee at home line of products. Their second (28K) and fifth (19K) aired ads in 2022 featured their new food products, such as their omelet bites and their roasted tomato toasts. In contrast, Starbucks ads in 2022 did not promote a singular product, or their coffee at home line, anywhere as much as Dunkin did. Starbucks ads in 2022 instead focused on promoting the company brand as a whole. For instance, their most aired ad in 2022 with 54K airings was a holiday themed ad of a student giving her teacher a Starbucks beverage and gift card, or their second most aired ad (57K) where a group of friends enjoy a collection of Starbucks beverages on a nice day.

According to QSRMagazine, McDonalds, Wendy’s and Burger King ranked as the top three fast-food burger chain restaurants in terms of 2021 sales. McDonalds, the top fast-food advertiser across all varied types of fast-food service chains in terms of airings, dominates the fast-food burger airings segments as well. McDonalds, in 2022 had more airings than Burger King and Wendy’s combined. McDonalds, Wendy’s and Burger King have overlapped in advertising in some major markets—Los Angeles, New York, and Philadelphia, but each chain has a different advertising focus. McDonalds spent heavily in Boston and Sacramento, representing the coast-to-coast dominance the chain has. The top three most aired McDonalds ads were all highlighting their breakfast service, with one ad highlighting both their breakfast as well as their new loyalty program. McDonalds’ focus on breakfast comes at a time when fast food restaurants are competing for the rapidly growing consumer demand for breakfast items. Additionally, McDonalds’ focus on their newly expanded loyalty program comes at a time were brands across all industries are developing their loyalty programs to help their customers through the tumultuous times. Wendy’s has tried to market more in the South, by proportionally having more airings in Houston and Miami, both markets in the two states and cities where Wendy’s has the most locations. Looking at airing data, Wendy’s prioritizes their unique deals, such as their $5 “Biggie Bag”, and like McDonalds’, Wendy’s also heavily advertises their breakfast options such as their french toast sticks and offering a free drink with any breakfast option. Burger King has focused a surprising number of airings in Honolulu, where they have 20 locations across the market. In the Honolulu media market, McDonalds has 5,000 airings, and Wendy’s has 4.8K. The most aired Burger King ad was their infamous Whopper song which aired 17,000 unique times across 2022.

In terms of sales, the top three pizza chains in the U.S. are Dominos’ Pizza Hut, and Little Caesars’, but in terms of airings, Papa John’s takes the third sport from Little Caesars’. Similar to the fast-food burger chain comparison, Dominos has more airings than their next two top competitors combined. Domino’s and Pizza Hut airs ads in the largest markets in the nation. Domino’s most aired ad in 2022 focused on giving customers 20% off online orders to help them feel relief during a spike in gas prices. This ad uniquely aired 108K times. Meanwhile, Papa John’s concentrates most of their airings to media marketing in the South. This aligns with the concept that Papa John’s has the most locations in Texas and Florida. Both Papa John’s and Pizza Hut’s advertising strategies featured new or returning products heavily. The most aired ad for Pizza Hut with 50K airings announced the return of their Detroit style pizza and for the most aired ad for Papa John’s with 77K airings announced their new New York style pizza.

Regional Fast-Food Analysis

Nationally recognized fast-food companies advertise across nearly all media markets. While there may be some deviation in the markets the national brands focus on, overall, the strategy remains the same. However, with regional fast-food chains, their advertising strategy depends on their regional strongholds. For instance, Pennsylvania-based Wawa will focus advertising in Pennsylvania and the Mid- Atlantic, where they have brand recognition, and southern California based Del Taco focuses on the Southwest. These regional chains have been expanding their advertising to new markets across the nation, foreshadowing their desired expansion into those new markets. Regional fast-food brands have increased their airings from the first quarter of 2023 compared to the first quarter of 2022.

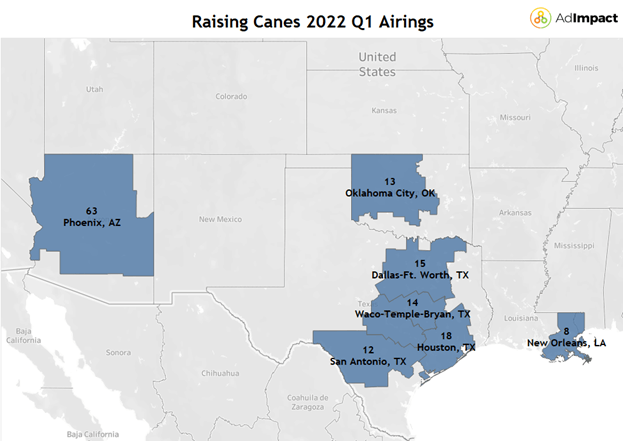

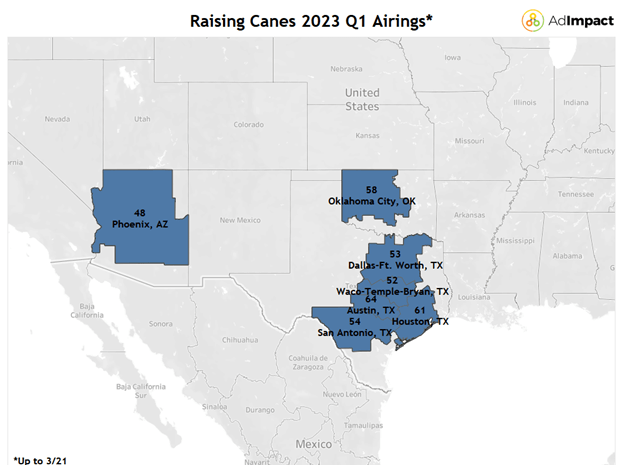

Founded in 1996 in Baton Rouge, Louisiana Raising Canes received its namesake from founder and CEO Tom Grave’s Labrador Retriever with a focus on chicken tenders. What started out as a local chain in the Baton Rouge market expanded throughout the state and into Texas and the southwest. Raising Canes has recently increased their presence on broadcast television. Raising Canes airings more than doubled between Q1 of 2022 (155) and Q1 of 2023 (390). This suggests Raising Canes will end 2023 with more airings than they did in 2022.

Raising Canes focused much of their Texas growth within the I-35 corridor, a densely population region that extends from the Dallas-Fort Worth metro area to San Antonio. So far in Q1 2023, Austin has the most Canes airings at 64, with Houston not far behind with 61. While Texas has seen the biggest airings increase from Q1 2022 to Q1 2023 the Phoenix market has seen a decrease in airings over the same period of time. While many fast food chains use advertising to emphasize the uniqueness of their products, Raising Canes utilizes the majority of its ads to try to localize the brand in a way that may connect with consumers who are looking to a brand connected to the community. One such example being this ad discussing how Raising Canes provides philanthropic financial contributions to local schools. In a press release on their website posted in 2022, Raising Canes has committed to opening 100 restaurants by the end of the year across Philadelphia, Phoenix, Florida, Michigan, Florida, and more, suggesting airings could be spotted in those markets soon.

Wawa is another regional chain has seen growth in airings from Q1 of 2022 to Q2 of 2023. Founded in 1902 as a delivery dairy service throughout the Philadelphia metro, Wawa has expanded from throughout the Northeast and Mid-Atlantic and more recently Florida. There were over two times more 2023 Q1 Wawa Broadcast airings (13,156) than in 2022 Q1 (5,324), which suggests that Wawa could be advertising more this year. While the Philadelphia media market continues to dominate amongst Wawa airings, the Orlando market eclipsed the Richmond market in Q1 of 2023 for second place. This is significant as it could indicate how Wawa’s Florida expansion has changed the advertising strategy for Wawa with a new focus on Sunbelt markets and away from their traditional current markets. More broadcast airings across the board could be indicative of Wawa’s revenue strategy. From 2021 to 2022 Wawa saw a 35% increase in revenue from $11B to $15B. As Wawa continues to expand, the company is looking to change things up by adding drive thru’s to their locations, which they have already test launched in Morrisville, PA,. This development represents a shift away from WaWa’s traditional quick service in store format.

Del Taco, founded in 1964, is a quick service Mexican food chain based in Southern California, with locations centered around California and the Southwest also saw an increase in Broadcast airings from Q1 2022 (5,452) to Q1 2023 (9,017). Notably, Del Taco had an airing in the Dallas market during Q1 2022, despite the fact that all Del Taco’s in Texas closed in 2015. There were more airings in Los Angeles, Las Vegas, Reno, and Salt Lake City in Q1 2023 with a noticeable dip in airings in Albuquerque and Yuma from Q1 2022 to Q1 2023. The most aired Del Taco ad which had 3,901 airings touts Del Taco’s new guacamole burrito which aligns with more Americans increasing preference for avocados. Del Taco is going through some structural changes after being acquired by Jack In The Box Inc which is planning on selling approximately half of its stores to new and existing franchisees.

Comparing advertising trends from national fast-food chains as well as regional ones can help give us a new perspective and insight into how companies' advertising strategies are expanding and reacting to feedback from consumers. AdImpact will continue to monitor fast food advertising, watching to see when In N Out Burger starts advertising and planning on opening branches for the rest of the country to enjoy!

Interested in more industry analysis from us? Check out our blog about this year's Oscars.