Written by Nate Schwartz

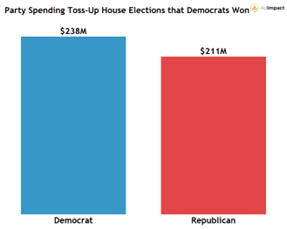

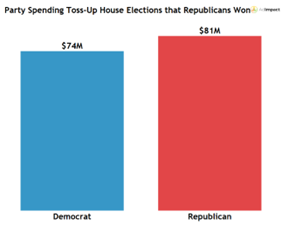

In a midterm election year, national focus lies on House and Senate races, which can alter the power structure of the country ahead of Presidential primaries. House races across the country possessed center stage in 2022 as many hypothesized there would be an impending red wave. While the House results ended up as a surprise to many, candidates and issue groups spent millions in advertising along the way. There was $1.4B in House race spending this cycle, making up 19% of all political ad spending in 2022.

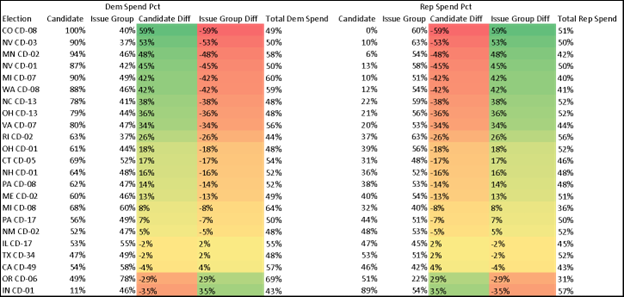

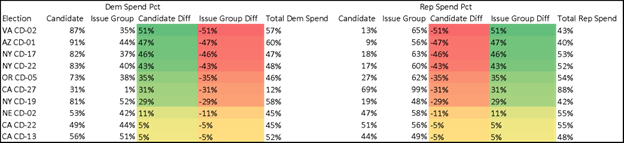

Within the House races, four major issue groups had a massive impact; they were responsible for $584M in these elections, which is about 42% of all House race spending. These four groups were GOP groups Congressional Leadership Fund and the NRCC, and Dem groups House Majority PAC and the DCCC. The DCCC and NRCC, which have both operated since 1866, have a chairman who currently serves in Congress. Congressional Leadership Fund and House Majority PAC were both founded in 2011 and have carried a heavier impact each year since 2018.

The DCCC outspent House Majority PAC in 2018, but trailed House Majority PAC by almost $50M in 2022. Meanwhile, the NRCC trailed Congressional Leadership Fund by around $50M in 2018 and was outspent by over $100M in 2022. Overall, the two Republican groups spent a combined $314M this cycle, compared to $265M from the two Democratic groups.

Across the four groups, there were two markets that saw significantly more House race spending than the rest: New York and Las Vegas. As a result of the competitive nature of multiple House districts in these two markets, the money poured in.

Even though the two Republican groups held an advantage in all five markets, they kept the party advantage close in four. New York, Las Vegas, Fresno-Visalia, and Boston saw $112.7M by these four groups, and the total divide was a 52%-48% Republican advantage. To get a deeper understanding of the two top markets, New York and Las Vegas, read our other blogs that do a deep dive about New York and Nevada.

In the Fresno-Visalia market, the most expensive race was CA CD-22, which saw $16.8M in total. The race saw $7.5M from the two Republican groups compared to $5.5M from the Democratic groups. The incumbent, Republican David Valadao, ended up holding on to the seat and won by three points. The other contested election in the market, CA CD-13, saw $4.2M from the two Democratic groups and $3.7M from the Republican groups. The Republican won here as well, with John Duarte edging out Adam Gray by 0.4 points.

The Boston Market includes New Hampshire spending, as New Hampshire does not have its own media market. These four House groups only spent on NH CD-01 and NH CD-02 in the market, and overall, AdImpact tracked just $680K on Massachusetts Congressional races within the Boston market. The most expensive race in the market was NH CD-01, which was the fourth most expensive House race of the 2022 cycle with $31.8M spent.

These four groups had a massive impact on the ad landscape, putting up over half of the ad spending for the entire race. However, the Republican effort was not completely cooperative, as GOP leadership was split in the primary. Karoline Leavitt won the Republican primary, despite CLF purchasing ads supporting Matt Mowers. CLF proceeded to spend exclusively on anti-Chris Pappas ads for the general, placing $4.4M worth of ads. Pappas won the election handily by eight points.

In NH CD-02, the four issue groups only made up 27% of ad spending in the race. A majority of the spending in NH CD-02 was by incumbent Democrat Ann Kuster, who spent $4.2M of the $7.0M in the election. She won the election in a landslide, defeating Bob Burns by 11.8 points. Both New Hampshire Congressional races were expected to be closer than the results ultimately indicated, with NH CD-01 being classified as a Democrat Toss-up and NH CD-02 being classified as a lean Democrat by Cook Political Report.

Congressional Leadership Fund and the NRCC spent $19.5M in the Los Angeles market, marking their highest investment in any market this cycle. Meanwhile, House Majority PAC spent $288K on the Democratic side. The DCCC did not spend in the market. This distribution is rather extreme, as most other large markets around the country typically include more suburban and rural districts deemed tossup elections.

In CA CD-47, CLF was the second biggest advertiser behind Democratic candidate Katie Porter, who spent $14.8M. CLF’s ads in this election were only focused on the economic issues: inflation, small businesses, taxation, and the economy itself. Some ads from CLF pitted Porter against other Democrats, suggesting that other Democrats help give money to families while she takes money out of their pockets. Porter ended up winning in a close election.

The other two elections in the Los Angeles market with significant House race spending from the two GOP groups were districts that the GOP was attempting to maintain. Cook Political Report had CA CD-27 as a Republican toss-up and CA CD-45 as lean Republican. Both elections resulted in Republican victories.

The other two elections in the market, CA CD-49 and CA CD-40, saw significantly less money. CA CD-49, a Democratic toss-up, only saw $1.8M in spending outside of the four groups. While the $288K investment from HMP looks small in comparison, it made up 16% of the spending in the election. CA CD-40, a lean Republican district, saw $3.0M in other spending. Both elections fell the way of their projection, as CA CD-49 went to Democrat Mike Levin and CA-40 went to Republican Young Kim.

The four groups aired an overwhelming number of negative ads. These groups seemed to favor showing why one should not vote for an opponent rather than supporting their party’s candidate. Ninety percent of the ads run by the groups had a negative tone, while 8% were contrast ads (both positive and negative) and 2% were positive.

The CLF & NRCC were more negative on average than their Democratic counterparts, with 95% of their ads having a negative tone. An example of this, the NRCC’s ad attacking Michelle Vallejo in TX CD-15 for wanting to defund the police, institute the Green New Deal, and end cash bail, shows the vitriol that some of these ads contained.

Meanwhile, 83% of HMP & DCCC ads conveyed a negative tone. An example of a negative ad by the groups was the DCCC’s ad about Lisa Scheller’s views on abortion in PA CD-07. Fifteen percent of the Democratic groups’ ads were contrast ads. House Majority PAC’s ad showing how Nikki Budzinski helped get Illinois a $15 minimum wage while opponent Regan Deering opposed it, exemplifying the type of contrast ad that these Democratic groups aired.

The top six issues mentioned in ads by these four groups were taxation, abortion, crime, special interests, Nancy Pelosi, and healthcare.

The most striking issue figure here is that the Democratic groups were the only ones to air ads that mentioned abortion. Abortion took on a more prominent role in leading political discourse this election cycle, and Democrats reflected it in their ads. On the other hand, the Republican groups were the only ones to mention Nancy Pelosi.

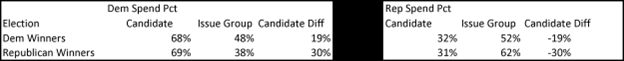

While Democrats ended up winning more seats than initially expected this cycle, Republicans still gained control of the House. These groups will continue to have a massive effect on the House ad landscape in 2024, though their targets and messaging strategies may differ significantly.