Written by Nate Schwartz

As the calendar soon turns to 2024, the Presidential election will emerge as the key focus across the country. Ad spending has already been in full swing for the primary, both on the Republican and Democratic side. The Republican primary has already seen $198M in ad spending and reservations supporting a plethora of candidates. On the Democratic side, 90% of the $51M spent has supported incumbent President Joe Biden’s re-election bid. Spending in support of Biden has come largely from four groups, which make up $44M of the $46M pro-Biden total.

Biden Victory Fund has exclusively spent on digital platforms and DNC/Biden is a coordinated buy between the campaign and the Democratic National Committee. Of the four advertisers, Future Forward USA Action is the only issue group not connected to the campaign.

Ad spending in support of Biden has coincided with recent polling creating doubts about his re-electibility. Specifically, a recent poll from the New York Times/Siena College indicated that Biden is losing to Trump in five of six key battleground states.

Comparing Biden’s off-year incumbent spending to both Trump’s 2019 and Obama’s 2011 strategies identifies two key themes: the amount of ad expenditure resembles Trump’s 2019 and the targeted focus of battleground states mimics Obama’s 2011.

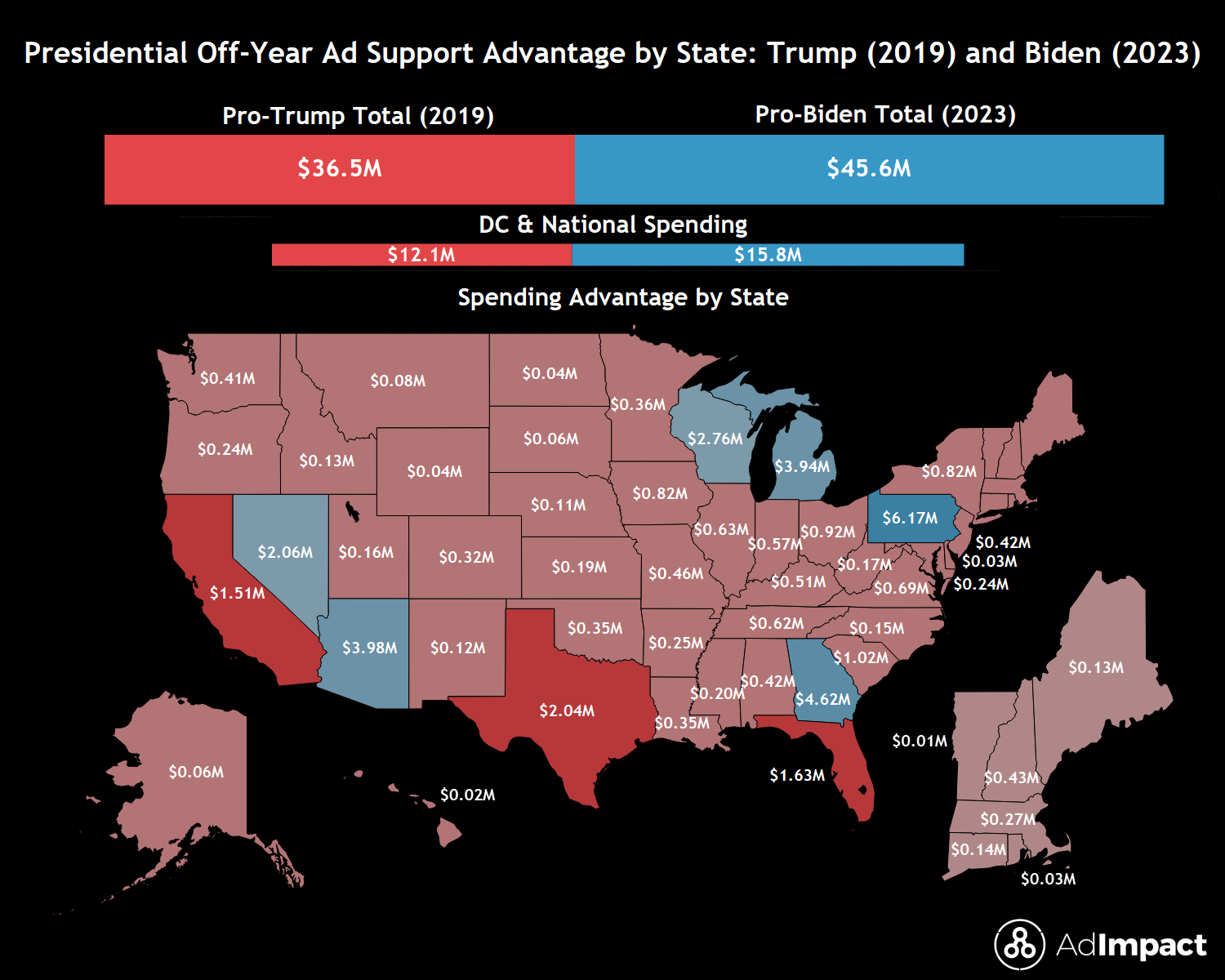

Throughout their respective off-years, this year’s pro-Biden spending is leading 2019 pro-Trump spending by $9.1M. This gap will likely continue to grow, as Biden supporters still have another month to place additional 2023 reservations. The two Presidents benefited from the most and second-most ad support for any incumbent in an off-year.

While they both saw significant support, the two Presidents had diverging strategies for their ad targets. Pro-Trump spending went nationwide, while pro-Biden spending has been focused on battleground states. In 2019, Trump saw at least $100K in ad support across 41 states, DC, and in national spending. This year, Biden has only seen that amount of support in eight states, DC and in national spending.

In comparing 2019 and 2023, Trump holds a spending advantage in 46 states because advertisers due to this blanketed approach. While some of those advantages are negligible (such as a $40K to $0 advantage in Wyoming), there are significant advantages in both highly-populated and former battleground states. The Trump campaign spent significantly in California ($1.5M) and Texas ($2.0M), two states that are historically solidly Democratic and Republican, respectively. Pro-Trump ad money also went to Florida ($1.6M) and Ohio ($900K), two states that voted Republican in 2020 and are not deemed as competitive as they once were.

This year’s Biden ad support holds an advantage in almost every state he is airing ads compared to Trump’s 2019 support. Biden’s most expensive state, Pennsylvania ($7.8M), is outpacing Trump’s 2019 support by $6.2M. Pro-Biden spending holds a multi-million dollar advantage in five of the six battleground states, with North Carolina being the only outlier. Trump’s 2019 support holds a $125K advantage in North Carolina: $932K to $807K.

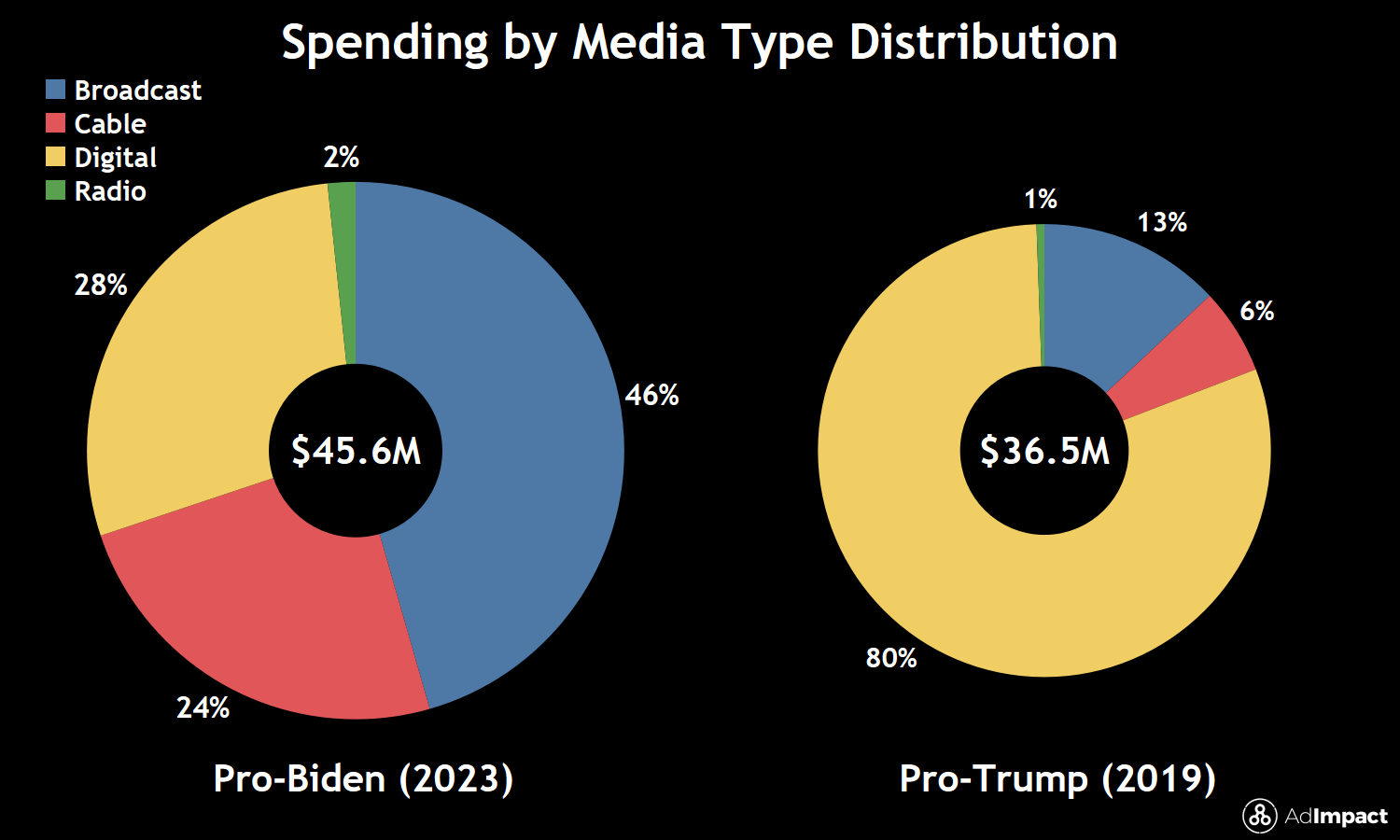

Not only is the state distribution differing, but the media type landscape looks vastly different between the two incumbents.

Ad expenditure supporting Biden varies across broadcast, cable, and digital, while almost all of Trump’s ad spending came across digital platforms. Trump’s top states were fully digital: Texas, Florida, and California all saw zero linear spending in 2019.

Trump’s 2019 linear spending more closely resembles Biden’s 2023 strategy. While pro-Trump spending only saw $7.2M on linear, the vast majority targeted battleground states (NV: $0.9M, PA: $0.6M), Republican primary states (SC: $0.6M, IA: $0.6M), or national networks ($3M).

Across all pro-Trump spending during the 2020 election, only 4.5% was spent in 2019.

Looking back to the last Democrat incumbent president to run for re-election, Biden’s ad strategy looks like that of pro-Obama advertisers in 2011. Linear ad spending supporting Obama’s re-election focused on states that ultimately decided the election. The top states for Obama during the off-year were Virginia, Florida, Ohio, Colorado, and North Carolina, which combined for $6.3M of the $7.3M off-year total. Other states that saw over $100K were Nevada and New Hampshire.

The five states that pro-Obama spending targeted most heavily ended up being the five closest states in vote margin. Obama won all of them except North Carolina, enroute to being re-elected. Interestingly, Obama’s campaign did not spend until 2012, as all of his off-year support came from issue groups. This year, advertisers tied to Biden’s campaign have contributed 52% of his total ad support. Obama saw an even larger share of spend in the election year than Trump, as only 1.8% of his total support came in 2011, compared to Trump’s 4.5% in 2019.

The vast majority of ad spending for Biden will come starting next year, but he’s already seen more spending as an incumbent than any other President in history. Based on 2023 spending, most of the 2024 spending appears to be headed toward the six battleground states, assuming he retains the nomination.

To learn more about Presidential spending on the Republican side, read our blog here: