Written by Meaghan Walsh

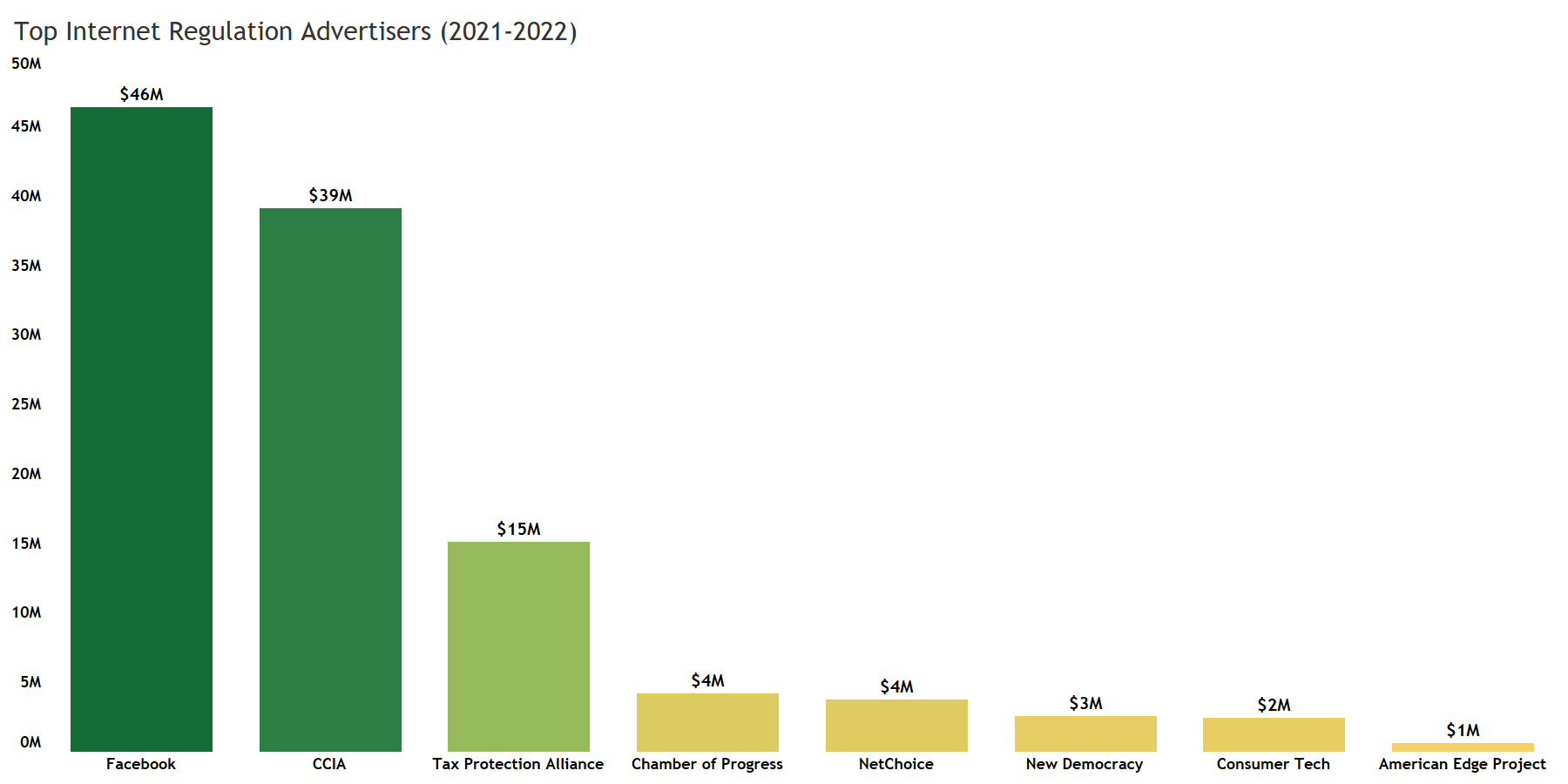

Internet regulation is a hot button issue. We have already seen almost an additional $29M spent on this issue in 2022 than in 2021, which saw $43M while 2022 is already at $72M. Last year, the internet regulation airtime was dominated by Facebook, who spent $41.7M on ads encouraging internet regulation updates. Now, the debate has shifted. A group of tech advertisers are leading the internet regulation discussion by pushing back against a series of digital regulation bills making their way through Congress. Spending totals increase by the day as advertisers attempt to influence lawmakers by flooding the market on this issue for this campaign spending analysis.

Throughout 2022, a handful of advertisers led by the Computer and Communications Industry Association (CCIA) have been campaigning against a group of internet regulation bills in Congress. These bi-partisan bills were proposed to limit the reach of tech giants after an investigation by the House Judiciary Committee revealed companies such as Apple, Amazon, Google, and Facebook have a near monopoly on the industry. Legislation of particular concern to stakeholders includes the Ending Platform Monopolies Act, the Platform Competition and Opportunity Act, and the Augmenting Compatibility and Competition by Enabling Service Switching (ACCESS) Act.

While these bills all have similar aims, the legislation that has caused the most uproar from tech advertisers has been S.2992, or the American Innovation and Choice Online Act (AICO). The bill is designed to prohibit tech giants from “giving preference to their own products on the platform” in order to increase fairness and competition. The anti-trust bill also includes data management regulations. Furthermore, it designates both the Federal Trade Commission and Department of Justice as the agencies in charge of enforcing these measures.

Campaign Spending Analysis: Advertiser Breakdown

Over the past year, we have seen 30 distinct anti-regulation creatives from these advertisers. Such massive saturation has led to an estimated 412M impressions across the country to date. The messaging for these ads is consistent across advertisers, focusing on how new legislation will hurt consumers, small businesses, and national security. They pose that these bills will increase the likelihood of cyber-attacks and harm industry competition. Furthermore, they specifically mention negative service disruptions to Google Maps and Amazon Delivery.

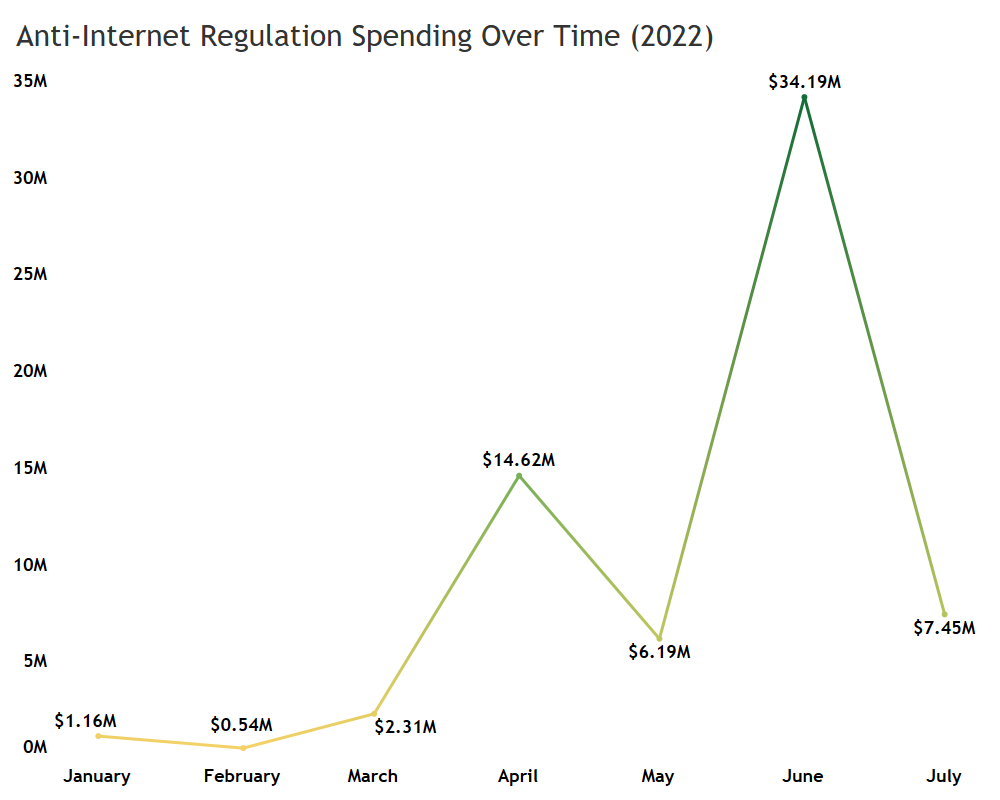

Internet regulation spending skyrocketed when anti-regulation advertisers spent a combined $43.8M on a new ad campaign attacking S.2992. The explosion in spending was likely caused by a new draft of the bill being circulated by its sponsor Senator Amy Klobuchar on Sunday, May 22.

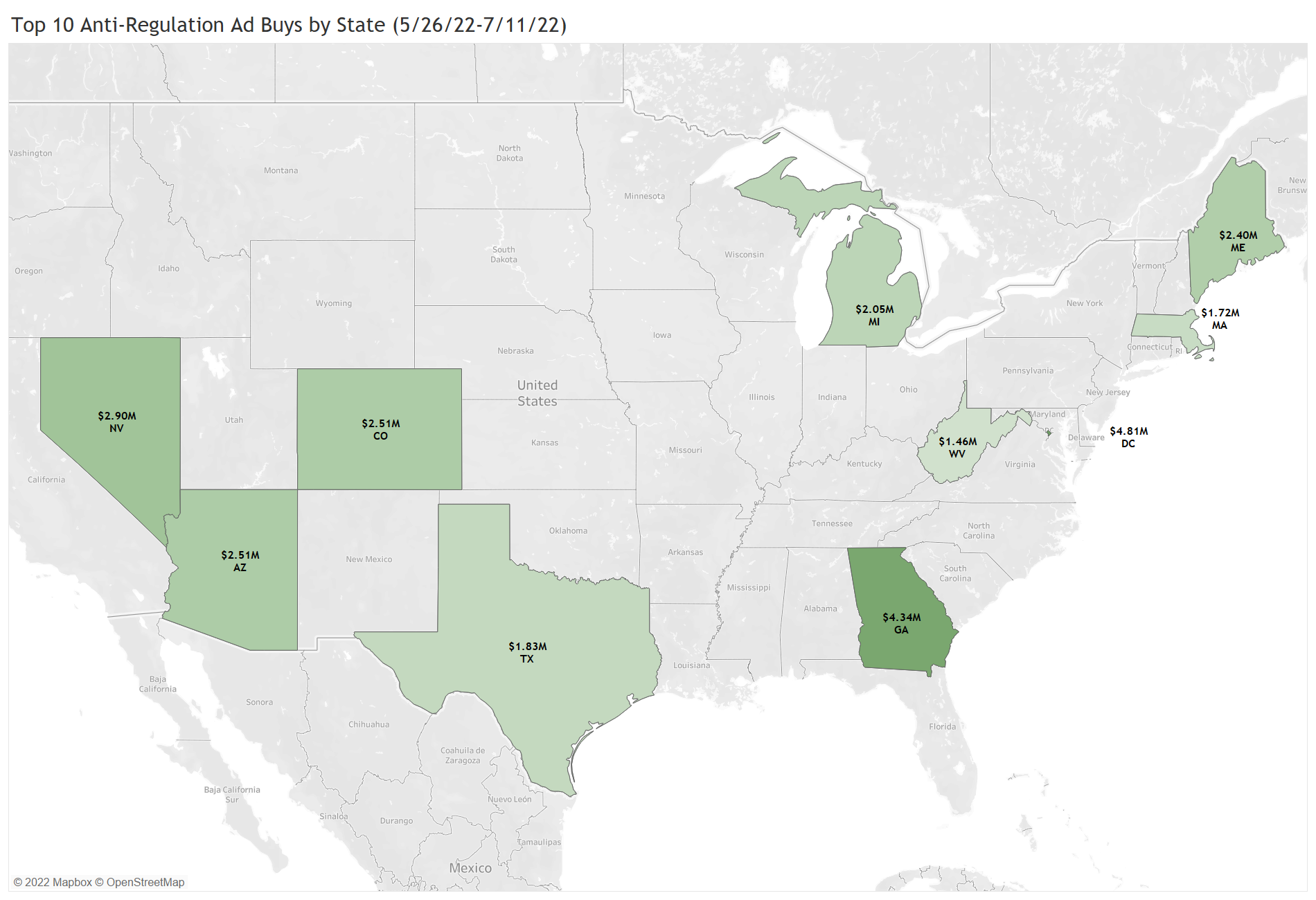

The ad campaign began on May 26, 2022 and will run until at least July 11, 2022. The ad buy will hit nearly 40 states. In 18 of these states, spending has reached over $500K. The largest share of spending will occur in GA with $5.5M placed, followed closely by DC with $5M, then Nevada with $3.7M, an finally Arizona and Colorado with $3M each.

Of these advertisers, the CCIA has invested the lion’s share into this issue, with over $22M in spending on this latest ad campaign. In this new buy, CCIA alone placed over $1M in GA, DC, NV, CO, AZ, MI, and MA. Other notable spenders in this ad blitz include the Taxpayers Protection Alliance with $11M, Chamber of Progress with $4M, New Democracy with $2.5M, Consumer Technology Association with $2.4M, and NetChoice with $927K.

Although anti-regulation spending accounts for a vast majority of the market, we have also seen some pro-internet regulation spending. The advertiser Tech Oversight Project responded to new anti-regulation trends by releasing a $174K ad buy beginning in June, targeting some of the states tech advertisers are attempting to garner support in with their new buy--such as GA, NV, AZ, and DC. The Tech Oversight Project messaging pushed back against what they saw as unsavory business practices among Facebook, Amazon, Google, and Apple. They also recently released a new advertisement directly supporting S.2992.

Facebook also spent $2.7M on new ads in late May of this year that highlighted the company’s increased safety and security measures. Notably, with this new buy their messaging changed from 2021 trends to highlight internal data privacy practices rather than continue their previous support for internet regulation measures.

There has yet to be a significant challenger to this new swarm of anti-regulation spending. Nearly every day anti-regulation advertisers are placing more money and adding new markets to this issue. It appears the battle between Congress and these tech advertisers has just begun, and we will continue to monitor the ever-increasing amount of spending around this topic going forward from this campaign spending analysis.